This actively managed fund primarily invests in equities of companies based in emerging market economies. At least 70% of the portfolio will be invested in shares of companies listed or conducting significant business in these regions.

The fund has the flexibility to invest across other asset classes, sectors, and countries, depending on market conditions and opportunities identified by the fund managers.

At present, this fund is most exposed in the financial, IT, consumer goods and industrial sectors — though this can shift over time. As it’s actively managed, these weightings don’t move in line with an index, but may be adjusted by the fund manager to manage risk or pursue investment opportunities as they arise.

This fund is actively managed. Instead of tracking a specific index, its holdings are chosen by professional fund managers, who are attempting to outperform a portion of the market. Managers may use a reference benchmark to help measure performance and manage portfolio construction — while reserving the freedom to make diversions from the index when they need to.

HSBC Asset Management is part of the wider HSBC Group, boasting over 50 years experience and managing $600 billion (2024).

HSBC focuses on bringing investors a low-cost range of investment products, with particular strength in global equity and ESG offerings.

VanEck is a privately-held global investment manager with 70 years experience and $114 billion in assets under management (as of mid-2024). Over the last 19 years, VanEck has pioneered over 100 specialty ETFs across a range of innovative thematic sectors such as gold, semiconductors, emerging markets, gaming and others.

iShares ETFs are managed by BlackRock, the world’s largest asset manager, with over three decades of experience in index investing. The team applies rigorous quantitative research and disciplined risk management to deliver diversified, cost-effective market exposure.

With a strong emphasis on transparency and innovation, iShares products are built to support efficient, long-term investment strategies.

BlackRock is the world’s largest asset manager. Founded in 1988, it provides a wide range of investment products and services to institutions, financial professionals, and individual investors worldwide.

Invesco is a global asset manager with over $1.4 trillion in assets (2024). They offer over 240 ETFs, covering equities, fixed income, commodities and thematics.

Founded in 1935, Invesco brings 90 years of experience creating reliable, investor-first solutions.

Vanguard has been providing investment solutions to everyday investors since the 1970s. Today, it manages $10 trillion for over 50 million investors worldwide (2024), sticking to a philosophy of low costs, transparency, and long-term thinking.

State Street Investment Management launched its first ETF in 1993, and has been managing client assets for 47 years. As of March 2025, State Street’s Investment Management division holds $4.67 trillion in assets under management, is the third largest ETF provider and fourth largest asset manager in the world.

Established in 1836, Legal & General (L&G) manages over £1 trillion in assets across equities, bonds, real assets, and multi-asset products. Their asset management arm manages over £517 billion across more than 400 index solutions.

WisdomTree is a global asset manager based in New York. With $116 billion under management (as of April 2025), they are a trusted provider of over 260 ETPs (Exchange Traded Products).

Their investment product philosophy seeks to use unique research to provide investors access to traditionally inaccessible asset classes.

China’s largest e-commerce platform and cloud services provider, often compared to Amazon.

SK Hynix makes memory chips (DRAM, NAND) used in devices from Apple, HP, and Lenovo

Major chip manufacturer supplying the global tech industry

A large Chinese internet services and technology company

Taiwanese cloud infrastructure specialists focused on servers, storage systems and networking equipment.

Brazilian investment management company, providing products and services across equities, fixed income, pensions, credit and more.

Enjoy a low platform fee of 0.25%, or continue with 0% platform fees with one flat membership of £5.99/month with ChipX. Standard fund management fees apply.

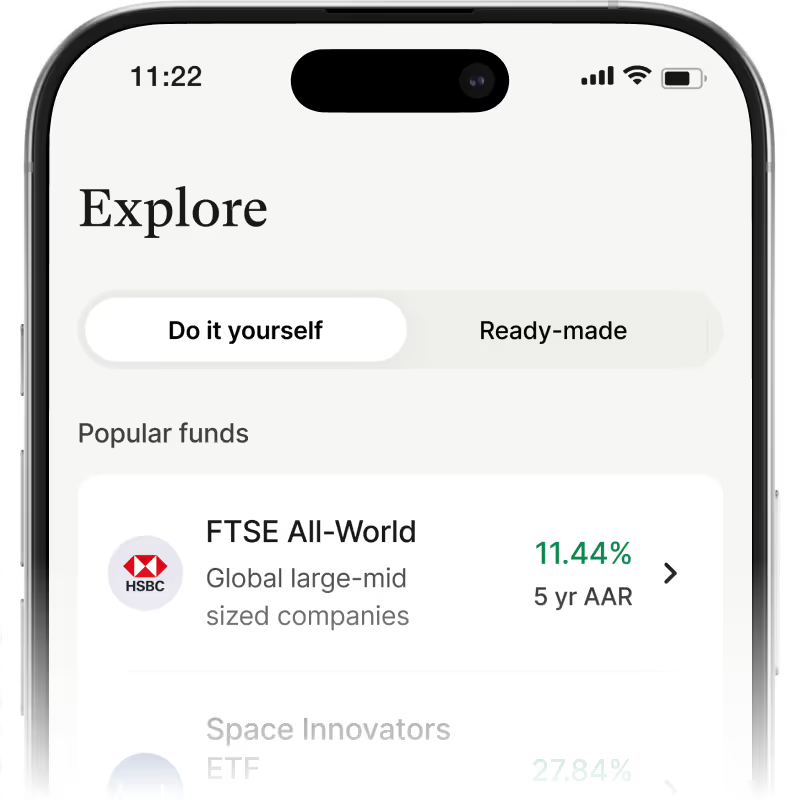

We keep it simple with a curated range of funds from some of the world’s biggest asset managers.

Set up recurring deposits directly into your chosen funds and save the payday admin.

Our Dual Track feature lets you choose from three risk levels, or create your own portfolio from a curated range of funds.

Step 1

Enjoy tax-free returns with a Stocks & Shares ISA and invest without limits with a General Investment Account.

Step 2

Choose to do it yourself and pick your own funds, or choose from our three ready-made options.

Step 3

Easily access your portfolio at your fingertips, and set up recurring deposits to build wealth for the future.

Avg. annual returns

06/01/2025 - 06/01/2026

+

14.28%

-

14.28%

Fund Provider

BlackRock

Management Charges

0.17%

Risk level

5 of 7

Category

Actively Managed

Region

Global

Avg. annual returns

30/01/2021 - 30/01/2026

+

9.09%

-

9.09%

Fund Provider

BlackRock

Management Charges

0.17%

Risk level

5 of 7

Category

Actively Managed

Region

Global

Avg. annual returns

30/01/2021 - 30/01/2026

+

7.25%

-

7.25%

Fund Provider

BlackRock

Management Charges

0.17%

Risk level

5 of 7

Category

Actively Managed

Region

Global

Avg. annual returns

30/01/2023 - 30/01/2026

+

6.83%

-

6.83%

Fund Provider

BlackRock

Management Charges

0.17%

Risk level

5 of 7

Category

Actively Managed

Region

Global

This fund does not aim to replicate a benchmark. Instead, it used the MSCI Emerging Markets Index as a reference (or constraint) to help guide how it’s managed, without directly copying it.

Emerging markets are countries undergoing development toward more advanced economic systems. Their markets are included in this index based on criteria such as size, liquidity, and accessibility.

This depends on your personal goals, time horizon, and risk appetite. Emerging markets can experience higher volatility than developed ones, and should generally be considered as part of a diversified portfolio.

The fund is diversified across companies, sectors, and countries within emerging markets. Because it’s actively managed, the fund manager can adjust the portfolio, increasing exposure to areas with more perceived potential and reducing it in regions or sectors they view as higher risk.

The fund is diversified across companies, sectors, and countries within emerging markets. Because it’s actively managed, the fund manager can adjust the portfolio, increasing exposure to areas with more perceived potential and reducing it in regions or sectors they view as higher risk.

Scan the QR code below to download the Chip app and get started.

or get a download link via email.