Savings done

your way.

Competitive rates, monthly prizes and award-winning tools for building your wealth.

We aim to find competitive rates for your savings.

Withdraw your money at any time.

Fully FSCS covered.

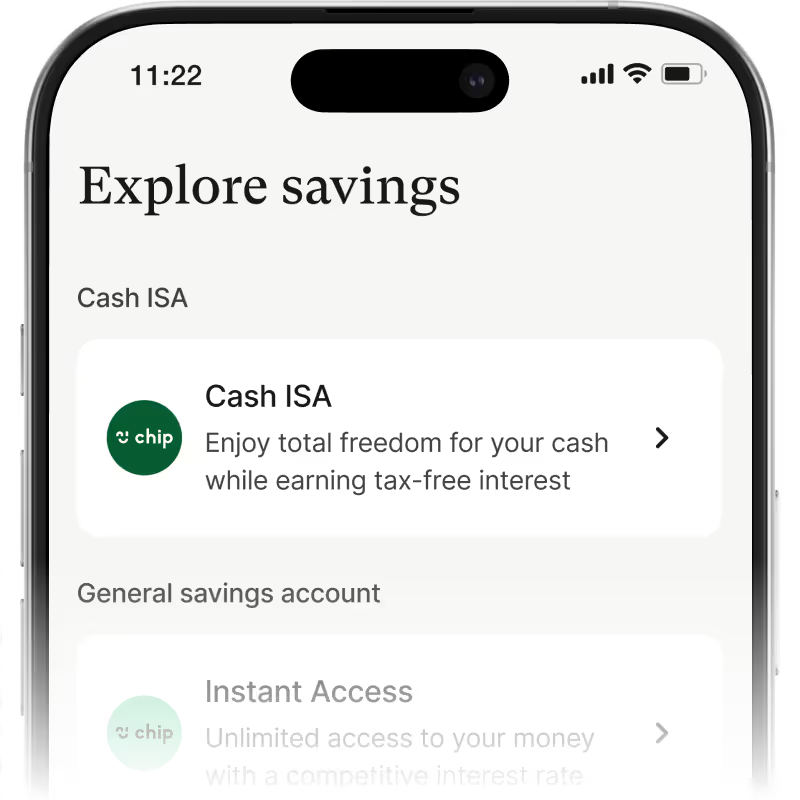

Meet our savings accounts.

We currently offer four savings accounts, all in one savings app.

How to choose the right savings account.

When you’re deciding on the right account for your savings, there are a few things you need to consider before you open a new savings account.

Think about what you want to achieve and how you want to get there. Try our savings goal calculator.

Consider what you're saving for and how you want to get to your specific goal. For example a short-term goal such as a holiday requires a different strategy to your long-term goals, such as retirement. Choose a savings account to reflect that.

If you’re saving for something like an emergency fund, it’s important to go for a savings account that gives you immediate access to your money. If your goal is in the future than a notice account allows you to lock some money away and avoid the temptation to spend.

Some easy-access accounts offer a competitive rate, but only allow a set amount of withdrawals per year for you to keep it. With our Chip Instant Access Account, there no penalties or reduction in your interest rate for withdrawing.

.png)

.png)

Why save with Chip?

From competitive rates to innovative products, we’re here to help you build your wealth effortlessly in one savings app.

Competitive rates

We keep our eyes on the market to make sure you’re always getting an amazing rate on your savings.

Withdraw anytime

Withdraw as many times as you like with no fees, penalties or reduction in your interest rate.

Fully FSCS covered

All of the savings accounts we offer are FSCS protected, giving you peace of mind. Find out more about how we protect your money.

.avif)

All our savings accounts are covered by FSCS.

All our savings accounts are provided by UK authorised banks and any money deposited in them is eligible for the Financial Services Compensation Scheme (FSCS), where the government guarantees the return of up to £120,000.

.png)

Build wealth automatically with Savings Plans.

All our savings accounts work with our Savings Plans, so you can automatically build your savings without thinking about it. Our savings app is designed to help build your wealth.

You can use both our award-winning Auto-Saving technology and our new recurring deposits feature to build fully customised savings plans. Charges may apply - read more on our pricing page.

You dream it.

We'll help you plan it.

Whether you’re saving up for a rainy day fund, a house deposit or for your next holiday, create the right savings goal for you. All in one savings app.

You'd hit your goal in

-

£0.00

+

£0.00

Achieve your goal by Wed 19 Mar 2027.

Earn competitive savings rates with Chip.

Chip is a savings app that’s always looking to give you better savings rates. With our intelligent automatic saving tools and plans, we’re here to help grow your savings. Learn how to save with Chip.

You can begin saving with our market-leading savings account for free today. Begin building your wealth effortlessly with Chip all through our savings app. Charges may apply.

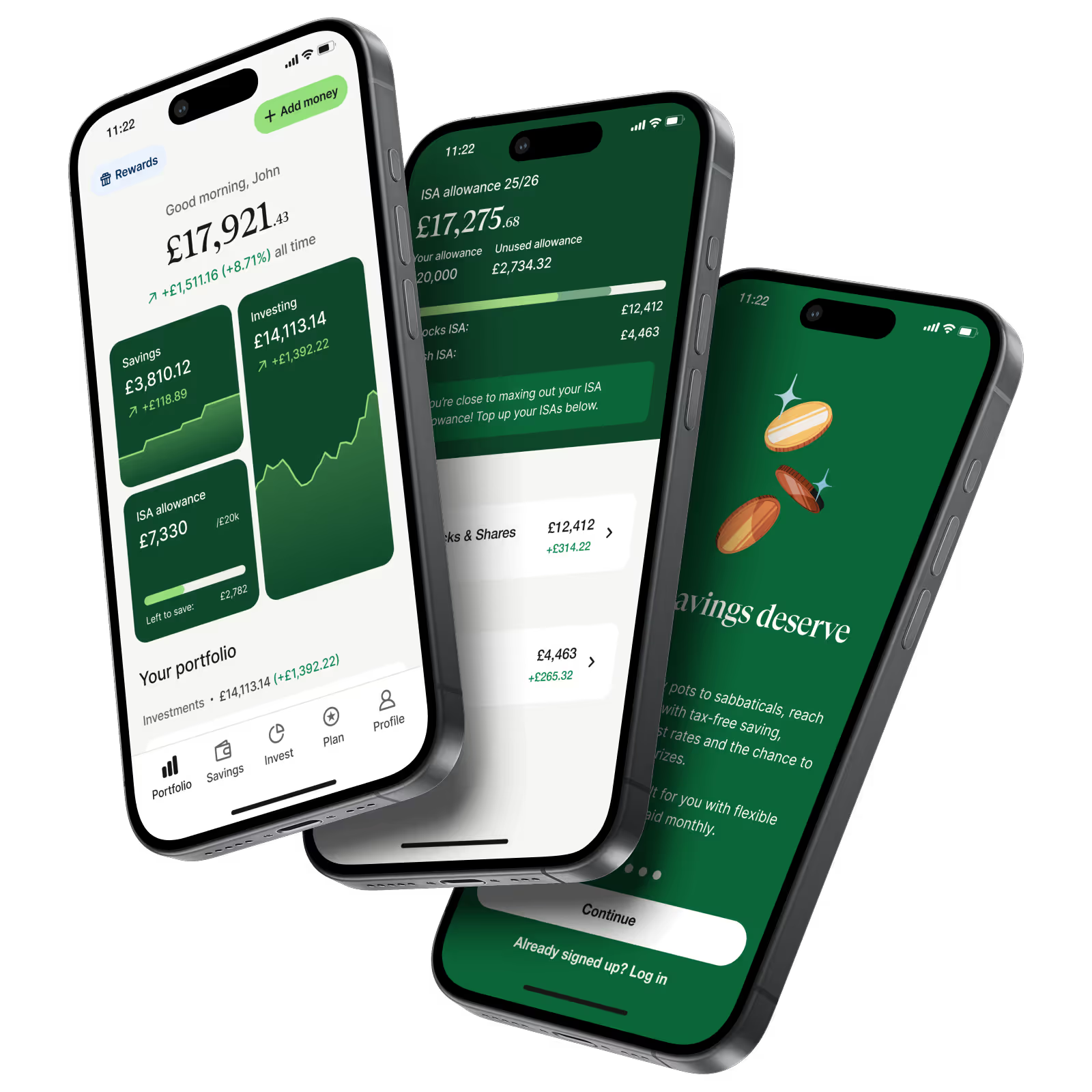

How to open your savings account.

We've made it easy to start building wealth with our savings accounts. No forms or fuss, get started in just a few minutes. Download the app via Google Play or App Store.

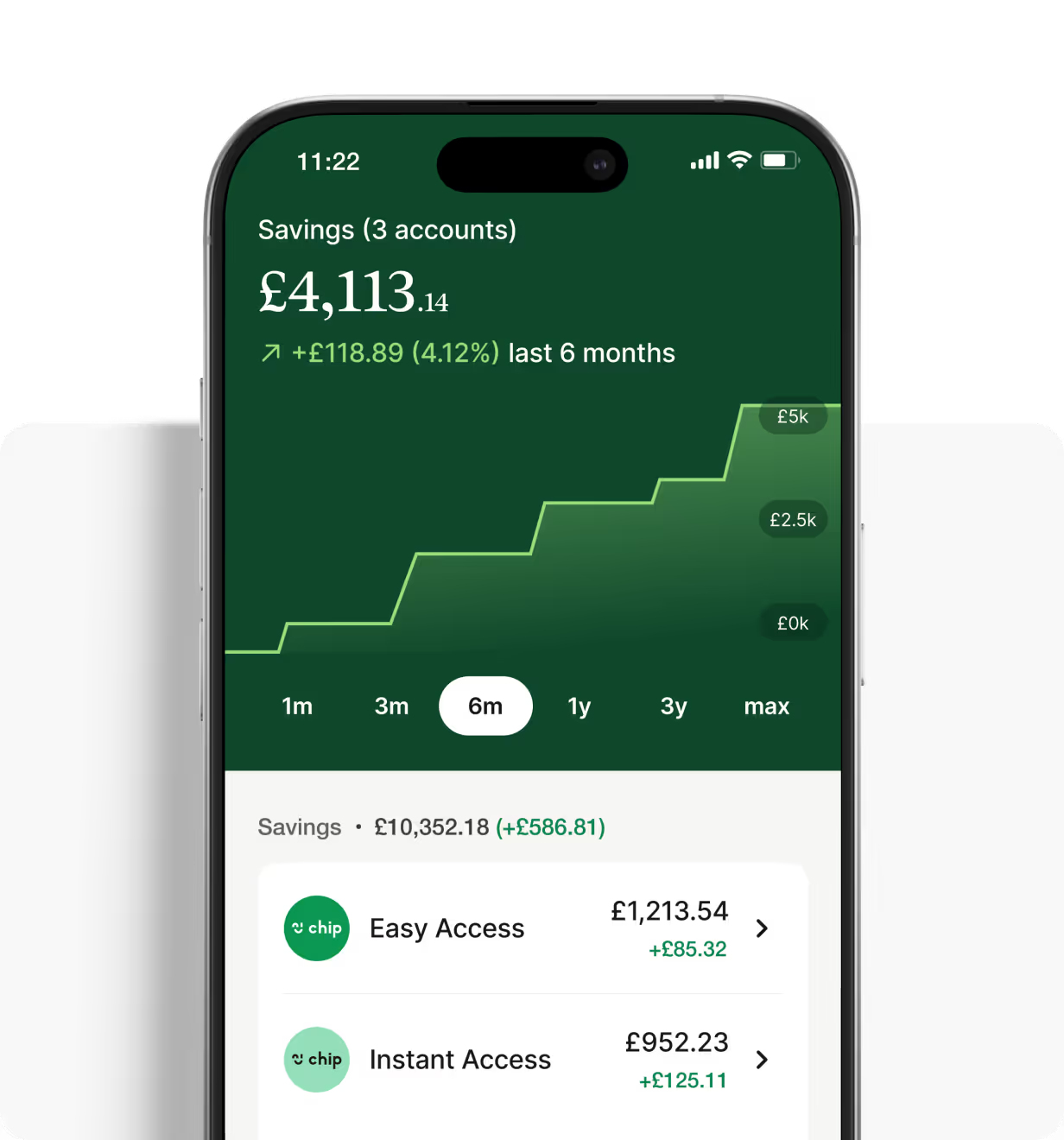

Find 'Savings' tab

On the ‘Savings’ tab of your Chip app, you can choose from a range of savings accounts offering great interests rates and chances to win big prizes.

Connect your bank

In order to make near instant saves and withdrawals, you just need to connect your bank. Follow the simple steps to add your account in a few taps.

Start saving!

Make your first deposit via bank transfer, from your Chip savings accounts or debit card and that’s it. Your account is open!

FAQs

Everything you’ve ever wanted to know about savings accounts.

Savings accounts and current accounts serve different purposes and come with distinct features. Savings accounts are, as the name suggests, designed for saving money. They tend to offer interest on the balance, encouraging individuals to save for the future. Current accounts, meanwhile, are primarily used for everyday transactions such as paying bills, making purchases, and receiving income.

does it protect my savings?

The FSCS is a government-backed initiative in the UK that provides protection for consumers in the event that their financial institution fails. This ensures individuals do not lose their eligible deposits if a bank or other financial institution becomes insolvent. Currently, the protection limit is £120,000 per person, per banking institution.