Investing made simple

Build your wealth without the stress. The investment app with auto-investing, curated funds, and low fees.

With investment, your capital is at risk.

Ready-made investment portfolios

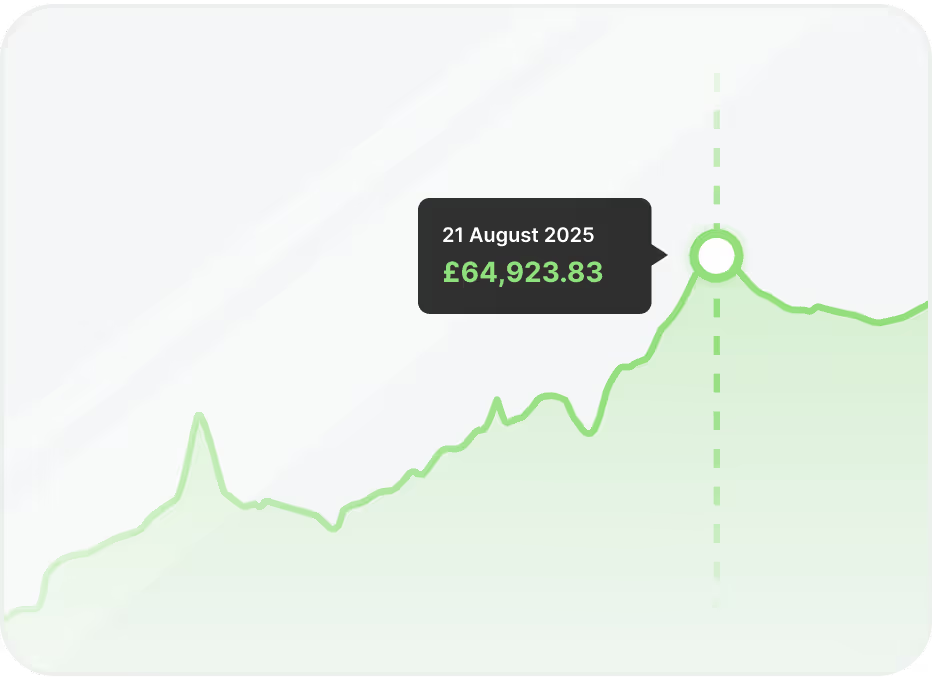

Auto-invest and watch your money grow

Curated funds from leading asset managers

With investment, your capital is at risk.

We’ve kept investing simple.

Why should you invest with Chip?

Tax-free investing made easy

Invest up to £20,000 a year in a Stocks & Shares ISA and keep every penny of your returns. No tax admin or paperwork.1

Grow your money on autopilot

Set up seamless recurring deposits and auto-investing that keep you on track without lifting a finger.

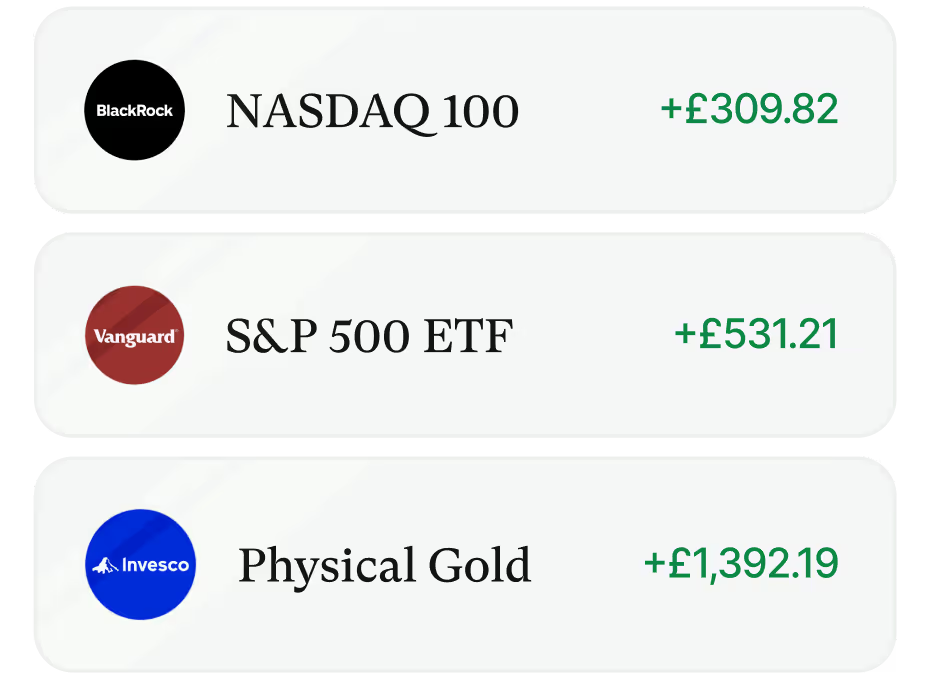

Funds from the biggest names

Choose from a curated range of investment funds from some of the world’s largest asset managers: BlackRock, Vanguard, Invesco, HSBC and more.

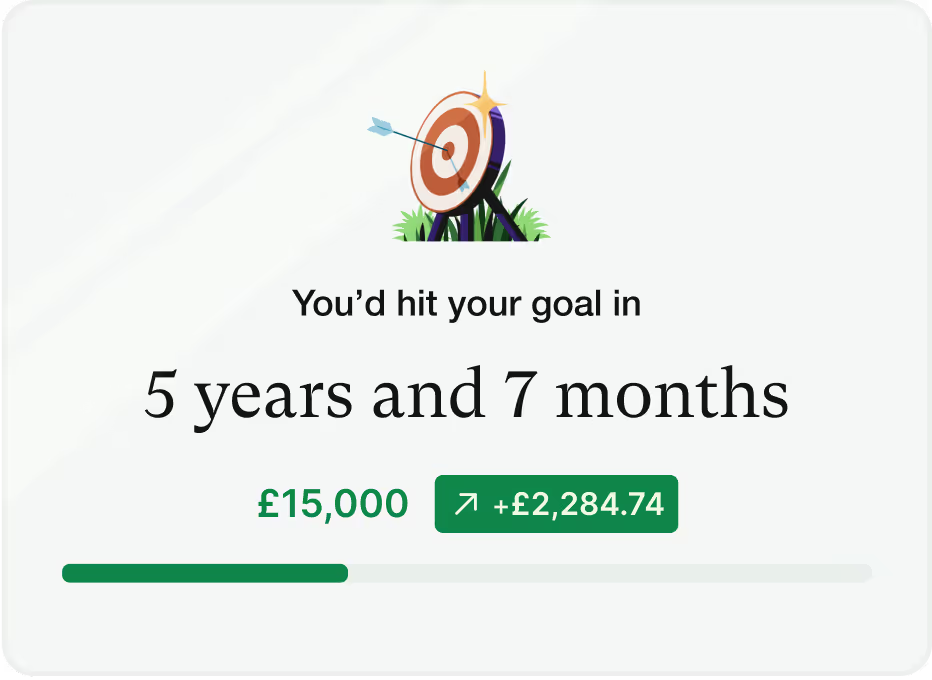

Make wealth building a reality

Our calculator tools help you visualise your financial goals, and build the plan to bring them even closer with investing.

What is investing?

Everything you need to know to get started

Investing is the act of putting your money into assets; like stocks, bonds, funds, property or businesses – with the goal of growing your wealth over time.

Our investment funds are collections of assets (like stocks, bonds, commodities etc.) that aim to give you exposure to multiple different investments, in one place.

Some funds focus on global economy, some on a particular theme, and others on a particular asset - like gold.

Investment fees are a normal and necessary part of investing. They cover the professional services that help your money grow safely and efficiently.

Platform Fees covers the running costs of your account on our platform. Our free plan has a 0.25% platform fee, while this fee is 0% with a ChipX membership*.

Fund management fees are charged by the experts who manage your chosen investment funds. They vary between funds and are automatically deducted from your investment.*

A monthly or annual ChipX membership fee is required and fund management charges apply.

‘Capital at risk’ means that when your money is invested, the value can go down as well as up. Historically, markets have trended upwards over time, and investments should be focussed on long-term goals.

Investment funds our

members love

Our curated range of funds was built with long-term growth in mind. Each investment fund is made up of a range of assets, so you don’t need worry about picking the winners.

Space Innovators

Semiconductor Fund

Physical Gold

China Fund

S&P 500 Tech

Blockchain & Crypto

NASDAQ 100

S&P 500

FTSE Global All Cap ESG

Adventurous ESG Fund

FTSE 100

FTSE All-World High Dividend

UK Large & Mid Cap

MSCI World

FTSE Developed World

Physical Silver

LifeStrategy 100%

FTSE All-World

AI Fund

FTSE Global All Cap

Europe ex-UK Fund

Asia Pacific ex-Japan Fund

Adventurous Fund

LifeStrategy 80%

India Fund

Global Luxury

Global Small Cap

Japan Fund

Automation & Robotics

Balanced Fund

S&P 400 Mid-Cap

Balanced ESG Fund

S&P 600 Small-Cap

LifeStrategy 60%

FTSE Emerging Markets

Cautious Fund

Megatrends

UK Money Market Fund

LifeStrategy 40%

Emerging Markets Fund

US Bond Fund

Healthcare Innovation

Clean Energy

Get your investments on track

Investing tools that put your goals in focus

Our simple calculator tools are designed to help you visualise your investing goals, make the right choices, and give you the numbers you need (without the maths degree). Whether you're starting with a lump sum, planning monthly deposits, or exploring potential returns — we’ve got you covered.

Popular

Stocks & Shares ISA Calculator

See how your ISA could grow over time - and what tax-free returns you could unlock.

New

Return on Investments Calculator

Project your potential investment returns based on how much, how long, and how often you invest.

Investment names you can trust

All in one app

We’ve selected a curated range of funds from some of the world's largest asset managers — Vanguard, BlackRock, Invesco and more — so you can invest with confidence.

Smart auto investing

Our smart Auto-investments feature analyses your spending habits to find the perfect amount for you to invest.

Simply set your preferences, and we'll automatically invest your money into a fund you've chosen.

You're always in control. You can pause or adjust your auto investments anytime.

Set investing goals

Ready to start your investing journey? Our Goals feature is designed to help new investors plan for the future.

Whether you're saving for retirement, a house deposit, or a big trip, you can create a specific investment goal and track your progress over time.

We help you stay focused on the long term, so you can build wealth for the things that matter most.

Complete

Financial freedom

£300,000

/

£300,000

Ahead

House deposit

£24,822.24

/

£40,000

On track

City break

£472.52

/

£2,000

Explore our funds

We’ve hand picked our range of investment funds to cater to every investor. Whether you’re looking for a simple option, or want to build your portfolio from scratch — we’ve got you covered.

With investments, your capital is at risk.

Explore our full fund range

We’ve hand-picked a range of investment funds for all risk levels. Whether you're cautious or adventurous, like Tech, Clean Energy, or Space Innovation - there's a fund for you.

Choose your investment track

Investing doesn’t have to be complicated. Our investment app offers simple, clear paths designed to help new investors get started. Pick the track that feels right for you to begin building your financial future with Chip.

Selected for you

Choose from three simple funds managed by experts at BlackRock.

No expertise needed

Choose from three simple options based on your investing risk level. It’s simple, effortless and hands-off.

Managed by experts

Fund managers at BlackRock buy and sell assets to keep your portfolio in line with your level of risk.

Start your journey from £1

No experience needed. Smart diversification across thousands of assets with risk control built in.

Do it yourself

Create your own portfolio from our curated range of investment funds.

Want more control?

Create your perfect portfolio and choose from over 40 funds across global or regional indexes, thematics, commodities and more.

Curated choices

We selected our funds to give our members simple choices that give access to many assets in one investment — no stock picking required.

Start your journey from £1

Get the ball rolling with no commitments. No minimum deposit or monthly top up required.

Master the stock markets

Invest with confidence

Start your investing journey with confidence. Our jargon-free investment guide series’ cover everything from the fundamentals to various investing strategies.

Beginner

Investing basics

Learn the core principles of investing to build confidence and get started on your journey.

Beginner

Asset classes explained

Understand the different types of assets you can invest in, from stocks to bonds and beyond.

Advanced

Investing trends & tools

Discover the latest investing trends and tools to build your portfolio confidently.

Advanced

Investing strategies

Learn effective investing strategies to grow your wealth over time.

Ready to start your investing journey?

Get set up with Chip in a few simple steps

Download the Chip app

Get started by downloading the Chip app from the App Store or Google Play.

Sign up

Set up your account in-app in minutes.

Open your investment account

Head over to the ‘Investing’ tab and choose from a Stocks & Shares ISA or General Investment Account.

Make your first investment

Choose from our ready-made options or pick your own funds — investing takes a few minutes.

It’s that simple

Ready to start building wealth for the long-term?

Got a question?

We’re here to help. Whether you’re stuck on something or just want to understand how it all works, our team’s on hand with quick, friendly support.

Fund management fees are charged by the fund manager to cover the cost of running a fund. These charges vary between funds, and are also expressed as a percentage of your portfolio.

*A monthly or annual ChipX membership fee is required and fund management charges apply.

A General Investment Account (GIA) is great for any investing outside of your ISA allowance. This account doesn’t offer the tax-free benefits of an ISA, but you can invest as much as you like.

If you need any help, our UK-based customer support team is available 7 days a week.